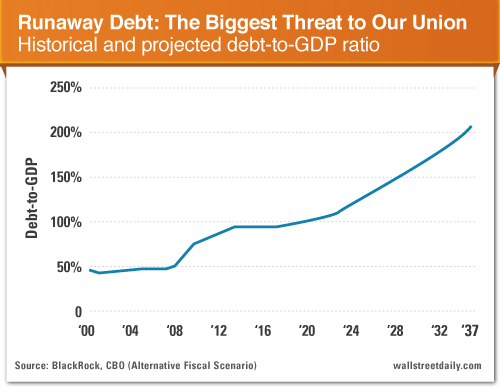

You heard Obama’s State of the Union. The Recovery, things are getting better, the exact same promises and hand wringing over the exact same supposed concern over the still unsolved problems of five years ago (and with continuing feigned lamenting by both parties repeatedly since then). This is the rest of the story, or the REAL story of where we–and most of the Western World– is economically in real terms. Absolutely flabbergasting facts, figures and math. Nope–you are not hearing the truth from government, or most media–and there are many reasons why. Just one happens to be that government check you get that is tied to the consumer price index. The higher reported inflation, the bigger the check you, and over 80 million other Americans receive. Imagine that. Real unemployment, real inflation, real deficits, real employment non-participation (8.5 million out of the workforce, getting government checks, not paying taxes) and real total debt (try 110 TRILLION!!!) are not things the folks “back there” want to discuss. They have many vested interests in insuring you don’t find out–or at least are not afforded enough dots to connect the lines, because the sum of this equation is downright petrifying. And you need to know–for you, for your family, and for the country. See the charts below as just a warm up to Reid’s eye opening part one of The State of Disunion.

You heard Obama’s State of the Union. The Recovery, things are getting better, the exact same promises and hand wringing over the exact same supposed concern over the still unsolved problems of five years ago (and with continuing feigned lamenting by both parties repeatedly since then). This is the rest of the story, or the REAL story of where we–and most of the Western World– is economically in real terms. Absolutely flabbergasting facts, figures and math. Nope–you are not hearing the truth from government, or most media–and there are many reasons why. Just one happens to be that government check you get that is tied to the consumer price index. The higher reported inflation, the bigger the check you, and over 80 million other Americans receive. Imagine that. Real unemployment, real inflation, real deficits, real employment non-participation (8.5 million out of the workforce, getting government checks, not paying taxes) and real total debt (try 110 TRILLION!!!) are not things the folks “back there” want to discuss. They have many vested interests in insuring you don’t find out–or at least are not afforded enough dots to connect the lines, because the sum of this equation is downright petrifying. And you need to know–for you, for your family, and for the country. See the charts below as just a warm up to Reid’s eye opening part one of The State of Disunion.Savers Footing the Bill for the Financial Crisis

Friday, 01 Mar 2013, By Newsmax Wires

In America and Europe, there is a silent transfer of wealth taking place every day as savings are eroded to fund government spending. Cash-strapped and heavily indebted governments are desperate to hold down the interest rate at which they borrow. This means perennially low interest rates for savers: rates so low that they don’t match the rate of inflation. The result is that retirees are forced to consume their wealth in order to pay the bills.

Click here to read the full analysis, written by Peter Warburton, PhD, only at LIGNET.com.

Student Debt Nearly Tripled In 8 Years, New York Federal Reserve Reports

Broke U.S. Government Eying Your Retirement Savings

Dodd-Frank’s new “consumer protection” agency wants to “help” Americans manage their nearly $20 trillion in retirement savings, and President Obama has tax loopholes in his sights.

Dodd-Frank’s new “consumer protection” agency wants to “help” Americans manage their nearly $20 trillion in retirement savings, and President Obama has tax loopholes in his sights.

It’s mattress-stuffing time.

You probably thought the Dodd-Frank Act was all about reining in greedy big banks and Wall Street predators.

Well then, what is the Consumer Financial Protection Bureau it established doing planning to “help” people manage the $19.4 trillion they’ve managed to save for their retirement?

CFPB director and longtime Democratic politician Richard Cordray earlier this month told Bloomberg News that managing retirement savings is “one of the things we’ve been exploring … in terms of whether and what authority we have.” (Read More)

Milton Friedman responds to President Obama’s proposal to raise the minimum wage, the most ‘anti-black law in the land’

The fact is, the programs labeled as being “for the poor,” or “for the needy,” [by politicians like President Obama] almost always have effects exactly the opposite of those which their well-intentioned sponsors intend them to have.

Let me give you a very simple example – take the minimum wage law. Its well-meaning sponsors [like President Obama]– there are always in these cases two groups of sponsors – there are the well-meaning sponsors and there are the special interests, who are using the well-meaning sponsors as front men. You almost always when you have bad programs have an unholy coalition of the do-gooders on the one hand, and the special interest on the other. The minimum wage law is as clear a case as you could want. The special interests are of course the trade unions – the monopolistic trade craft unions. The do-gooders believe that by passing a law saying that nobody shall get less than $9 per hour (adjusted for today) or whatever the minimum wage is, you are helping poor people who need the money. You are doing nothing of the kind. What you are doing is to assure, that people whose skills, are not sufficient to justify that kind of a wage will be unemployed. (Read more)

This time is different. This is an important one.

Posted by Richard R. Allen on February 26, 2013 at 3:32pm

I have spent the past week or so doing research to write a blog on the dangers involved in the current government’s spending policies and the effect they will have on each of us. Then I received this email from The Sovereign Man, aka Simon Black. I will still write that blog at a later date but Mr. Black has stated it so well and with a different approach than I am planning that I wanted to share his comments with you. The following is the Email I received in toto:

I have spent the past week or so doing research to write a blog on the dangers involved in the current government’s spending policies and the effect they will have on each of us. Then I received this email from The Sovereign Man, aka Simon Black. I will still write that blog at a later date but Mr. Black has stated it so well and with a different approach than I am planning that I wanted to share his comments with you. The following is the Email I received in toto:

By 1789, a lot of French people were starving. Their economy had long since deteriorated into a weak, pitiful shell. Decades of unsustainable spending had left the French treasury depleted. The currency was being rapidly debased. Food was scarce, and expensive.

Perhaps most famously, though, the French monarchy was dangerously out of touch with reality, historically enshrined with the quip, “Let them eat cake.”

The Bourbon monarchy paid the price for it, eventually losing their heads in a 1793 execution. But it took the French economy decades to finally recover.

Along the way, the government tried an experiment: issuing a form of paper money. It didn’t matter to the French politicians that every previous experiment with paper money in history had been an absolute disaster.

As French Assemblyman M. Matrineau put it in 1790, “Paper money under a despotism is dangerous. It favors corruption. But in a nation constitutionally governed, which itself takes care in the emission of its notes [and] determines their number and use, that danger no longer exists.” (Read More)

The State of the Union in One Chart

Important Articles to Read:

-

Jim Rogers to Moneynews: ‘We Should Be Terrified’ Because Fed Tactics ‘Going to End Badly’

-

Peter Schiff: US Will Win Currency War; Economy Will ‘Implode’

One Response to “The State Of Disunion. Part One–Time For Tough Love. This Is Not The Great Recession–It Is The Great Deception. Reid’s Research Reveals Facts , Figures and Truths–Not Politics, Just Math–That Will Stun You”

Read below or add a comment...