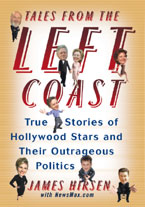

Join Reid and James Hirsen–author of Tales from the Left Coast, a NYT Bestselling book, and frequent guest on all major networks from CNN and MSNBC to ABC to Fox and America’s largest radio shows from Savage to Baldwin, Ingraham and Prager for a discussion of how Hollywood, and the entertainment media in general get their talking points from the white house, create reasons for mainstream media to cover “the news” by again mouthing the chart. James has interviewed Hollywood–Voight, Baldwin, Davi, Brenner, Mel Gibson and many more. He knows what makes them tick. Fascinating dialogue about the why, the when and the result. And the result is a furthering of .the Progressive agenda by folks who because of their name and wealth will never be affected, folks who by virtue of their power insulate themselves from adhering to laws and guidelines that bind the rest of us, and folks who simply don’t give a damn about the middle class–particularly women and the young. And Reid finishes off the last half of the show with some hair raising revelations, details and sources on the shut down, ObamaCare costs to real people, the beginnings of the crack in liberal armor over the upside down cake of the ACA grand opening and the real chaos behind the web site. Think this is a glitch? Think it is just too much traffic (both points propagated by the white house, picked up by the entertainment world and then regurgitated again by the MSM–a case in point from the Hirsen interview right before our eyes). And yet another administration misdirection–there was NO raise in the debt ceiling! Nope–wait til you hear these dirty little details! The die was cast in 2011 by Mitch McConnell himself–and right now we have no limitation on debt. Which leads us to what each of us owes, and far more important, the gift we are giving our children–500k billing statements folded in an envelope with an “I love you Not” note. How would you feel, you moms out there, if you opened an envelope from your parents on your eighteenth birthday with a 500k bill? Think about it! Then stop deluding yourself, that “phew, we escaped that disaster (shutdown/debt ceiling)” escape mentality. With the help of our MSM and Hollywood friends, we have avoided only the knowledge of the wreck. The train hit the wall some time ago.

Join Reid and James Hirsen–author of Tales from the Left Coast, a NYT Bestselling book, and frequent guest on all major networks from CNN and MSNBC to ABC to Fox and America’s largest radio shows from Savage to Baldwin, Ingraham and Prager for a discussion of how Hollywood, and the entertainment media in general get their talking points from the white house, create reasons for mainstream media to cover “the news” by again mouthing the chart. James has interviewed Hollywood–Voight, Baldwin, Davi, Brenner, Mel Gibson and many more. He knows what makes them tick. Fascinating dialogue about the why, the when and the result. And the result is a furthering of .the Progressive agenda by folks who because of their name and wealth will never be affected, folks who by virtue of their power insulate themselves from adhering to laws and guidelines that bind the rest of us, and folks who simply don’t give a damn about the middle class–particularly women and the young. And Reid finishes off the last half of the show with some hair raising revelations, details and sources on the shut down, ObamaCare costs to real people, the beginnings of the crack in liberal armor over the upside down cake of the ACA grand opening and the real chaos behind the web site. Think this is a glitch? Think it is just too much traffic (both points propagated by the white house, picked up by the entertainment world and then regurgitated again by the MSM–a case in point from the Hirsen interview right before our eyes). And yet another administration misdirection–there was NO raise in the debt ceiling! Nope–wait til you hear these dirty little details! The die was cast in 2011 by Mitch McConnell himself–and right now we have no limitation on debt. Which leads us to what each of us owes, and far more important, the gift we are giving our children–500k billing statements folded in an envelope with an “I love you Not” note. How would you feel, you moms out there, if you opened an envelope from your parents on your eighteenth birthday with a 500k bill? Think about it! Then stop deluding yourself, that “phew, we escaped that disaster (shutdown/debt ceiling)” escape mentality. With the help of our MSM and Hollywood friends, we have avoided only the knowledge of the wreck. The train hit the wall some time ago.

[ca_audio url_mp3=”https://ontherightsideradio.com/wp-content/uploads/2013/10/James-Hirsen-Interview.mp3″ url_ogg=”” skin=”regular” align=”none”]

-

Listen to Reid discuss more about the Total United States Debt and Obligations-And of Each American

-

For more from James Hirsen, visit his website and get your copy of his book “Tales From the Left Coast”

-

And, don’t forget to your copy of Reid’s #1 bestselling, multiple award winning “Land for Love and Money”

More from our Celebrities:

-

Celebrities tweet views on government shutdown

-

5 Celebrities Who Could’ve Stopped the Government Shutdown

-

Celebrities React to Government Shutdown – Read Hollywood’s Thoughts

Important Articles to Read:

-

Obama & Congress Taking Advantage Of Unlimited Spending

-

Rand Paul’s New Constitutional Amendment Should Be a Litmus Test for Who Stays in Congress

-

Government Reopens, Spends $328 Billion In A Single Day

-

The Debt Ceiling Wasn’t Raised, Just Disregarded

-

I Know Exactly What the Fed’s Next Move Will Be

-

ObamaCare Website–Not Just a Glitch–BROKEN

-

Why Obamacare is a mess

-

The Affordable Care Act Just Isn’t Affordable for These People

-

Government Shutdowns, the Debt Ceiling, and Our Mountain of Debt

-

How the Broadcast Networks Spun the Shutdown Obama’s Way

-

Trey Gowdy Blasts National Parks Service Director Jonathan Jarvis Over Memorial Barricades

-

150 Straight Days: Treasury Says Debt Stood Still at $16,699,396,000,000

-

Government Shutdowns, the Debt Ceiling, and Our Mountain of Debt

-

US court says Bernanke doesn’t have to testify now

-

11,588,500 Words: Obamacare Regs 30x as Long as Law

|

||

We can all stop panicking… The government is open for business.

We can all stop panicking… The government is open for business.

Or maybe that’s a good reason to panic.

Just after midnight last night, President Obama signed a bill to reopen the government and raise the U.S. debt ceiling. “We’ll begin reopening our government immediately,” Obama said last night at the White House. “And we can begin to lift this cloud of uncertainty and unease from our businesses and from the American people.”

Yes, the uncertainty and unease has disappeared from the American people… That is… until we do this all over again in about four months.

Yes, the uncertainty and unease has disappeared from the American people… That is… until we do this all over again in about four months.

The government didn’t solve anything… It merely delayed the date of its difficult decision.

The government didn’t solve anything… It merely delayed the date of its difficult decision.

We haven’t done anything to address our fiscal issues. America’s debt and spending are still out of control. And the past two weeks have been a comical distraction to the serious decisions we have to make as a nation.

But looking at the market today, you’d think all is well… The stock market was mostly flat as of midday trading today.

But looking at the market today, you’d think all is well… The stock market was mostly flat as of midday trading today.

The Volatility Index (the “VIX”), the market’s fear gauge, was down around 7.5% earlier this afternoon. The VIX measures the prices people are willing to pay for options that protect the value of their stock holdings. That’s why we call the index the market’s fear gauge: The higher the VIX, the more people will pay to insure their stocks…

So investors are complacent. They seem unaware that our issues haven’t changed… only delayed.

Gold acted as it should. The precious metal is up more than 3% today to nearly $1,325 an ounce. Yields on the 10-year Treasury dropped to 2.6%.

Gold acted as it should. The precious metal is up more than 3% today to nearly $1,325 an ounce. Yields on the 10-year Treasury dropped to 2.6%.

Our good friends at Casey Research recently published an interview with founder Doug Casey on libertarianism and the U.S. government. Doug is one of the great libertarian thinkers of our time. We always love to hear what he has to say. You can find his comments on the government shutdown below…

Our good friends at Casey Research recently published an interview with founder Doug Casey on libertarianism and the U.S. government. Doug is one of the great libertarian thinkers of our time. We always love to hear what he has to say. You can find his comments on the government shutdown below…

|

At least China understands what’s happening with the U.S. economy. Remember, China is the largest foreign holder of U.S. Treasurys, with around $1.3 trillion.

At least China understands what’s happening with the U.S. economy. Remember, China is the largest foreign holder of U.S. Treasurys, with around $1.3 trillion.

Chinese ratings agency Dagong downgraded the U.S. this morning from “A” to “A-“, maintaining a negative outlook. From Dagong’s press release…

|

Standard & Poor’s (S&P), one of the big three U.S. credit-ratings agencies, said it was minutes away from further downgrading the U.S., according to an exclusive report from Newsweek. The company’s global head of sovereign ratings, John Chambers, told the magazine…

Standard & Poor’s (S&P), one of the big three U.S. credit-ratings agencies, said it was minutes away from further downgrading the U.S., according to an exclusive report from Newsweek. The company’s global head of sovereign ratings, John Chambers, told the magazine…

|

Chambers said the U.S. would have gone into “selective default” if an agreement wasn’t reached. That is the lowest of S&P’s 20 ratings… a rating that currently belongs to just the Caribbean island of Grenada.

Chambers said the U.S. would have gone into “selective default” if an agreement wasn’t reached. That is the lowest of S&P’s 20 ratings… a rating that currently belongs to just the Caribbean island of Grenada.

If, as a nation, we’re minutes away from sharing the same credit rating as Grenada, perhaps we’re not worthy of such a high sovereign rating.

And perhaps S&P would have done its job – assigning an accurate rating to the U.S. – if it wasn’t so afraid it would get bullied by the government afterward.

Earlier this year, the U.S. Department of Justice sued S&P for failure to warn investors that the housing market was collapsing. It said S&P knowingly inflated the ratings of risky mortgage investments and that S&P gave those high markings to win repeated business from the banks issuing the mortgage securities.

Earlier this year, the U.S. Department of Justice sued S&P for failure to warn investors that the housing market was collapsing. It said S&P knowingly inflated the ratings of risky mortgage investments and that S&P gave those high markings to win repeated business from the banks issuing the mortgage securities.

S&P said the lawsuit was “retaliation” for its 2011 U.S. credit downgrade. The government’s hypocrisy is laughable.

Source: By Porter Standsberry at the S & A Digest