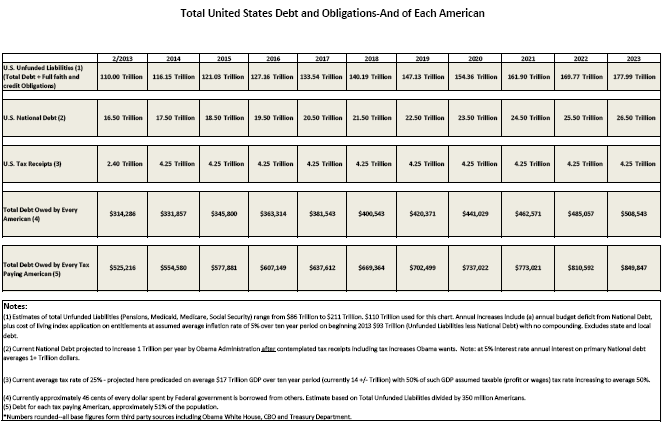

You heard Obama’s State of the Union. Part One of this two fisted blockbuster series of shows reviewed the mantras and promises of the last four years–merely repeated in the “State of The Union” The Recovery, things are getting better, unemployment is going down, deficits will be brought under control, we are all sooooooooo concerned about this national debt thing–and guns–from the president who “supports the second amendment, doesn’t mind folks owning guns, just wants us to be safe. Wait until you hear what he, and his minions have really said, and how they have always voted. Jobs? Economy? Growth? This is the rest of the story–the REAL Reality–Absolutely flabbergasting facts, figures and math. You are being kept in the dark like mushroom sheep. A few examples? Real total debt? (Try 110 TRILLION!!!), REAL annual deficits? (Try 7 TRILLION), REAL net growth in jobs over the last four years? (TRY 28,000–7,000 PER YEAR–nope, not a typo) These ain’t things the folks “back there” want to discuss. The sum of this equation is downright petrifying. And you need to know–for you, for your family, and for the country. See the charts below as just a warm up to Reid’s stunning reveal of REALITY in this Part Two of The State of Disunion.

You heard Obama’s State of the Union. Part One of this two fisted blockbuster series of shows reviewed the mantras and promises of the last four years–merely repeated in the “State of The Union” The Recovery, things are getting better, unemployment is going down, deficits will be brought under control, we are all sooooooooo concerned about this national debt thing–and guns–from the president who “supports the second amendment, doesn’t mind folks owning guns, just wants us to be safe. Wait until you hear what he, and his minions have really said, and how they have always voted. Jobs? Economy? Growth? This is the rest of the story–the REAL Reality–Absolutely flabbergasting facts, figures and math. You are being kept in the dark like mushroom sheep. A few examples? Real total debt? (Try 110 TRILLION!!!), REAL annual deficits? (Try 7 TRILLION), REAL net growth in jobs over the last four years? (TRY 28,000–7,000 PER YEAR–nope, not a typo) These ain’t things the folks “back there” want to discuss. The sum of this equation is downright petrifying. And you need to know–for you, for your family, and for the country. See the charts below as just a warm up to Reid’s stunning reveal of REALITY in this Part Two of The State of Disunion.

(Click on image for larger version)

[ca_audio url=”https://ontherightsideradio.com/wp-content/uploads/2013/02/State-of-Disunion-The-stark-reality.mp3″ width=”400″ height=”27″ css_class=”codeart-google-mp3-player” autoplay=”false”]

Important Articles to Read:

Author Quotes Then-Professor Obama Saying, ‘I Don’t Believe People Should Be Able To Own Guns’

In his new book, At the Brink, economist and author John R. Lott Jr., assesses the presidency of Barack Obama and recalls conversations regarding gun laws they had while working at the University of Chicago.

In his new book, At the Brink, economist and author John R. Lott Jr., assesses the presidency of Barack Obama and recalls conversations regarding gun laws they had while working at the University of Chicago.

In Chapter Three, Mr. Lott discusses gun-control and takes the reader back to his time at the University of Chicago, where he and then-professor Barack Obama spoke on numerous occasions about guns in America.

“I don’t believe people should be able to own guns,” Obama told Lott one day at the University of Chicago Law School.

Lott explains that he first met Obama shortly after completing his research on concealed handgun laws and crime.

“He did not come across as a moderate who wanted to bring people together,” Lott writes. (Read More)

Voters say sequester is needed because Congress incapable of cutting the budget

American voters think the impending across-the-board budget cuts, known as the sequester, are what it will take to get the federal deficit under control — because there’s no other way Congress will do it. In addition, less than half think the cuts will have a negative effect on the country.

A new Fox News national poll shows 57 percent of voters think the “only way” to control the deficit is through actions like the automatic cuts because lawmakers are unable to do it on their own. Some 29 percent have confidence that Congress has the know-how and power to make it happen.

Click here for full poll results.

The $85 billion in mandatory cuts are set to take effect Friday.

While 45 percent of voters think the consequences of the cuts would be negative, slightly more say they would either have a positive effect (27 percent) or not make much of a difference (22 percent).

Even voters who think the cuts would have a negative effect are more likely to say sequester-style tactics are necessary to control the deficit. (Read More )

Argentina: A Glimpse Into America’s Future

Published on Wed, 22 Aug 2012

By Bill Bonner, Founder and President, Agora Inc

Argentina is a political mess. But then again, so is the United States. By studying what’s happening to our south, we can see what lies ahead.

Have we told you how much we love Argentina? It’s a dream… at least for an economist with an “I-told-you-so” bent and a sense of mischief. For everyone else, it is a nightmare.

Argentina is to the economist what a corrupt small town must be to the novelist, where he can see who’s sleeping with whom, who’s drinking too much, who’s not paying his bills, and who’s getting too fat. Who’s doing right… who’s doing wrong… so much inspiration!

In Argentina — past and present — we get to see the whole gamut of how much damage economists and politicians can do. (Read more)

This time is different. This is an important one.

Posted by Richard R. Allen on February 26, 2013 at 3:32pm

I have spent the past week or so doing research to write a blog on the dangers involved in the current government’s spending policies and the effect they will have on each of us. Then I received this email from The Sovereign Man, aka Simon Black. I will still write that blog at a later date but Mr. Black has stated it so well and with a different approach than I am planning that I wanted to share his comments with you. The following is the Email I received in toto:

I have spent the past week or so doing research to write a blog on the dangers involved in the current government’s spending policies and the effect they will have on each of us. Then I received this email from The Sovereign Man, aka Simon Black. I will still write that blog at a later date but Mr. Black has stated it so well and with a different approach than I am planning that I wanted to share his comments with you. The following is the Email I received in toto:

By 1789, a lot of French people were starving. Their economy had long since deteriorated into a weak, pitiful shell. Decades of unsustainable spending had left the French treasury depleted. The currency was being rapidly debased. Food was scarce, and expensive.

Perhaps most famously, though, the French monarchy was dangerously out of touch with reality, historically enshrined with the quip, “Let them eat cake.”

The Bourbon monarchy paid the price for it, eventually losing their heads in a 1793 execution. But it took the French economy decades to finally recover.

Along the way, the government tried an experiment: issuing a form of paper money. It didn’t matter to the French politicians that every previous experiment with paper money in history had been an absolute disaster.

As French Assemblyman M. Matrineau put it in 1790, “Paper money under a despotism is dangerous. It favors corruption. But in a nation constitutionally governed, which itself takes care in the emission of its notes [and] determines their number and use, that danger no longer exists.” (Read More)

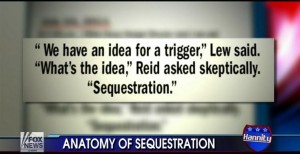

Obama Caught Lying about Sequester

Here is one thing that Obama should do to elevate America’s public discourse: Stop lying.

Here is one thing that Obama should do to elevate America’s public discourse: Stop lying.

Obama has been caught red-handed lying about the sequester, the $85 billion in automatic budget cuts that commence Friday, unless Congress panics and scuttles this 2.4 percent reduction in Washington’s heroin-strength spending addiction.

“The sequester is not something that I’ve proposed,” Obama said in his October 22, 2012, debate with GOP nominee Mitt Romney. “It is something that Congress has proposed.” (Read more)

| Very Serious Stuff: War Cycles Hit This Year! Prepare Now … |

||

| by Larry Edelson | ||

|

I may be one of the only analysts out there making that forecast, and you might think it’s crazy. That’s okay. It’s all the more reason for you to find out all the details: You don’t make money following the crowd. You make money by thinking outside of the box … by seeing what others can’t see … and by positioning your investments accordingly Now, on to a topic that I believe is critical for your understanding of the markets this year … War Cycles— So if you think all is calm now, or relatively calm … And if you think that President Obama’s ending of our role in Afghanistan signals the end of the war on terrorism … Then I urge you to reconsider your views by taking a look at what my war research is telling me. You see, just like business cycles, or various different economic cycles, the waging of war within and between nations has definite, identifiable rhythms. In my research on war, which has covered more than 5,000 years of war data, I’ve found that there are three distinct cycles to war. There are the 8.8 and 17.7 cycles. They in turn are sub-cycles of a larger cycle that’s 53.5 years in duration. The 53.5-year cycle can be seen in this cycle chart here. As you can clearly see, the 53.5-year War Cycle nailed major turning points …

It then …

The 53.5-year cycle has been turning up ever since. It should now be picking up momentum as its amplitude is not set to peak until 2027. Now consider the shorter-term war cycles. Consider the 17.7-year cycle shown here. You can see how it too uncannily pegged important turning points, right on cue. The Civil War, the Spanish-American War, the financial Panic of 1907, the end of WWI, the beginning of WWII for the U.S., the Korean War, the Vietnam War, and more. Where does it stand now? This war sub-cycle is pointing directly up into 2014! Now consider this next chart I have for you, which synthesizes the 53.5, the 17.7 and the 8.8-year war rhythms into one chart to give you a complete picture of where we stand right now. We are right on the edge of seeing the war cycles turn violently higher, heading all the way up into the year 2019 before any lull is found. What kind of war could we be facing? It could be … • Another surge of terrorism • A civil war and the breakup of Europe • Massive civil unrest in the U.S. • A war in the Middle East • A war between China and Japan over the Senkaku (or Diaoyu) Islands • A war between China and Vietnam, Malaysia and the Philippines over the Spratly Islands • A Cyber war • Massive uncontrolled currency wars Or any combination of many or even all of the above! It’s coming. You can see it in the increased tensions between China and Japan.

Between China and the U.S. Between North Korea and the U.S. Between North Korea and Japan. Between China and Vietnam and other countries laying claim to the Spratly islands. And it’s going to impact markets in ways you simply must prepare for. It will likely drive U.S. equities sharply higher. It could be the main trigger for gold and other commodities to finally enter the next phase of their bull legs higher. It would send interest rates higher, and bond prices lower. It could cause all kinds of economic and financial repercussions that will either strip you of your wealth this year … Or help you become richer than Midas. |

Only an Economist Can Think This Way

Published on Thursday, 19 July 2012, by Bill Bonner, Founder and President, Agora Inc

What’s so bad about stable prices? Economists across the globe are sounding the alarm about deflation. Their misguided “science” will hurt us all.

What’s so bad about stable prices? Economists across the globe are sounding the alarm about deflation. Their misguided “science” will hurt us all.

Dow up 103 points. Gold down $18/oz.

“Parece normal, pero no es,” said Juan Carlos, who is hosting us here in Madrid.

It looks normal, but it’s not.

The jobless rate here is nearly 25%. Youth unemployment is twice that. The banks hold billions of euro worth of loans that will never be repaid. The government borrows to make ends meet. But if lenders become just a little more demanding, the jig will be up.

The yield on the Spanish 10-year note is just a shade under 7% as I type. Greece lasted 17 days after its 10-year borrowing costs hit the same level. Ireland held out a couple of months. Then caved. Ditto Portugal. (Read More)

The War of 1812

The War of 1812

I just listened to your show from Saturday…..I love how you used a VERY common sense approach so the average folk (me) can access and use your information…. all of it from the cell phone BS, gun control/gun background checks to the connection/bridge over to the deficits/economics etc. and the birth control example, how much money really is saved/spent, those are such great examples for people!!!

Katherine A–Denver